Audit for HongKong Company

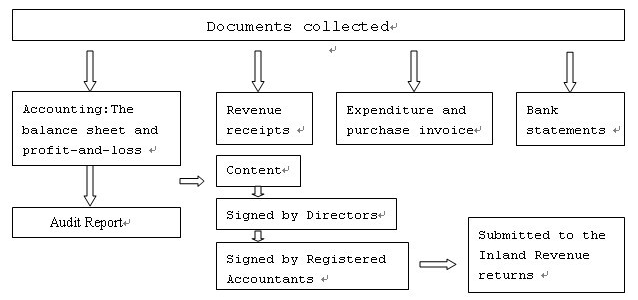

HongKong companies are accustomed to annual fiscal year-end on 31th March or 31th Dec, you may postpone tax returns. About 18 months after the establishment of each HK Limited, the HongKong Inland Revenue Department issued the profits tax returns. Audit Report is audited by Certified Public Accountants, together with the tax returns were send in to Inland Revenue.How to do an Audit Report?Here is a flowchart:

Second, accounting:The balance sheet and profit-and-loss, You can own accounting,sampling error rate of no more than 5%

At last,it is the Audit Report.it must be done by the Registered Accountants as demanded by HK business Laws.

How to keep the business records?

| A FILE | B FILE | C FILE | D FILE |

| Purchase invoice | Sells invoice | Bank statements | Administration expenses |

|

Purchase goods from suppliers and get receipts or invoices and stamp by the suppliers Purchase contract |

Receive money from clients issue receipts or invoices to them by your HK company Sells contract |

Make a record: how the expenditure and purchase and sells match with the bank statement and match with the bank statement. |

Payroll Travel expenses Accommodation Utility bills Rent |

Services

L E A V E

L E A V E